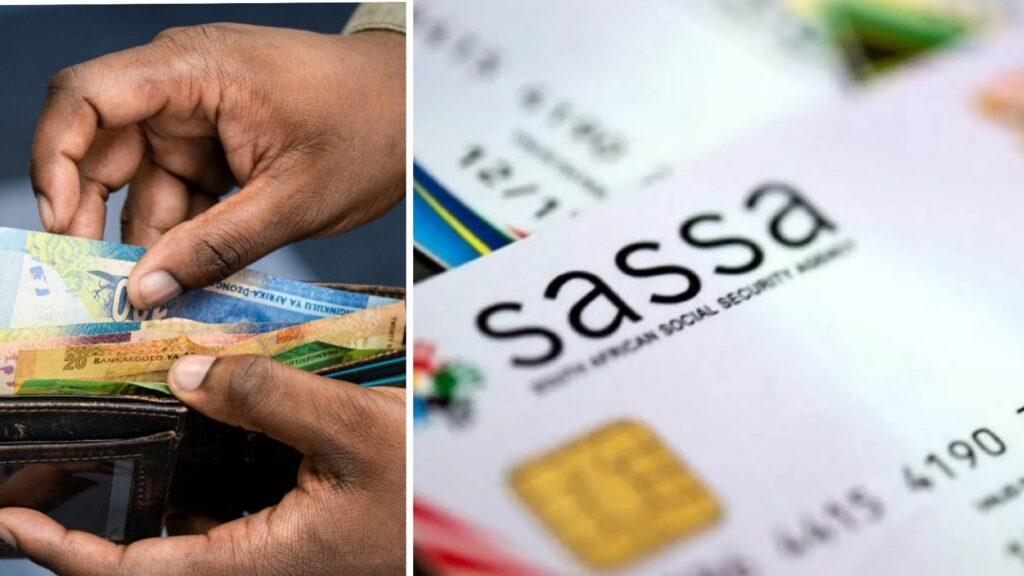

The South African Social Security Agency (SASSA) is undergoing a transformative shift in 2025, driven by two major initiatives: the introduction of a Universal Basic Income (UBI) Grant and the rollout of a modernized digital payment system. These changes aim to address systemic inefficiencies, reduce fraud, and ensure financial inclusivity for millions of beneficiaries. Here’s an in-depth analysis of these groundbreaking developments.

1. The Universal Basic Income (UBI) Grant

Overview

The UBI Grant is a landmark policy designed to replace the temporary SRD Grant, offering a permanent, unconditional monthly stipend to all eligible South Africans aged 18–59. Unlike means-tested grants, the UBI is universal, requiring only proof of citizenship or permanent residency.

Key Details

| Aspect | Details |

|---|---|

| Amount | R800–R1,200/month (final amount pending government approval) |

| Eligibility | South African citizens/permanent residents aged 18–59 |

| Application Process | Online via the SASSA portal or in person at offices |

| Payment Methods | Bank transfers, mobile wallets, or cash pickups at retailers |

Objectives

- Poverty Alleviation: Provide a financial safety net for 18 million+ South Africans living below the poverty line.

- Economic Stimulus: Boost local economies by increasing disposable income for essentials like food and healthcare.

- Simplified Administration: Eliminate complex eligibility checks, reducing bureaucratic delays.

Challenges

- Funding: Requires R266 billion annually, potentially necessitating tax hikes or reallocation of existing budgets.

- Inflation Risks: Critics warn that widespread cash injections could drive price increases for basic goods.

- Political Support: Opposition parties question long-term viability, advocating for job creation over grants.

2. Digital Payment Modernization

SASSA’s new digital payment system, launched in partnership with EasyPay Everywhere, replaces outdated infrastructure like the SOCPEN system. This overhaul prioritizes speed, security, and accessibility.

Features of the Digital System

- Biometric Verification: Fingerprint and facial recognition to combat fraud.

- Multiple Access Points:

- Mobile Wallets: Funds accessible via smartphones, even without bank accounts.

- Retail Cash Withdrawals: Pick n Pay, Shoprite, and Boxer stores serve as cash points.

- ATMs: Withdrawals using the new EasyPay card.

- Financial Inclusion Tools: Savings plans, microloans, and insurance products for long-term stability.

- SASSA Payments Dates for December 2024

- SASSA Biometric Identity Verification for SRD Grant – 4 Things To Do

- How to Change SASSA SRD Banking Details to TymeBank

Benefits

- Reduced Queues: Instant digital transfers eliminate long waits at payment centers.

- Enhanced Security: Encrypted transactions and biometric checks minimize theft and fraud.

- Rural Accessibility: Mobile agents deliver services to remote areas lacking banking infrastructure.

Challenges

- Digital Divide: 30% of beneficiaries lack smartphones or internet access, risking exclusion from biometric systems.

- Transition Hurdles: Elderly beneficiaries may struggle with new technology, requiring targeted support.

3. Synergy Between UBI and Digital Upgrades

The UBI Grant’s success hinges on SASSA’s digital infrastructure:

- Efficient Distribution: Real-time payments ensure UBI stipends reach beneficiaries promptly.

- Fraud Prevention: Biometric verification prevents duplicate claims and identity theft.

- Financial Literacy Programs: SASSA plans to educate beneficiaries on managing UBI funds via mobile apps.

4. Future Outlook

- UBI Expansion: If successful, the grant could evolve into a tiered system, with higher amounts for vulnerable groups.

- Technological Innovations: AI-driven fraud detection and blockchain-based transactions may further secure payments.

- Policy Debates: Civil society groups advocate for inflation-linked grant adjustments to preserve purchasing power.

Conclusion

The fusion of UBI and digital modernization positions SASSA to revolutionize social welfare in South Africa. While challenges like funding gaps and the digital divide persist, these initiatives promise greater inclusivity, efficiency, and economic resilience. For beneficiaries, staying informed about application processes and leveraging digital tools will be key to maximizing the benefits of this new era.

Internal Linking Suggestions:

- Learn about SASSA’s SOCPEN system challenges → Understanding SASSA Grants in 2025.

- Avoid fraud with biometric checks → Fraud Prevention in SASSA Payments.

- Manage UBI funds effectively → Financial Literacy for Grant Recipients.

This forward-looking analysis underscores SASSA’s commitment to aligning with global payment trends while addressing South Africa’s unique socio-economic needs.

One Comment

Comments are closed.